Co-operative Central Bank, Penang

Work at the Penang Bridge project was nearing completion, so I decided to make the next move. We had installed a house telephone along the way. The installation deal came with 2 booklets, 1 yellow pages and the other Advertisements. I searched through all the banks and sent in my application with my resume, hoping for the best. I waited and there were a number of bank interviews but I was not selected. I trusted in Him, there was something else for me. Then sometime in November, I received an interview offer from Co-operative Central Bank in Jalan Bunus, Kuala Lumpur. I took a couple of days annual leave and went for the interview. In December 1984, I received a telephone call offering me the job and I was to start work on 2nd January 1985 at the CCB’s branch in Penang. It was at 385, Chulia Street! That was not too far from where we lived.

I did not really have any clue how this bank operated. I was just excited to be working in a “bank” – the name itself was glamourous. Later on, I found out that this bank was not a commercial bank although the operations were like one. CCB had branches all over Malaysia and it was well known. On my first day I met with the bank manager, Mr Eu, he talked for a bit and introduced me to his deputy, Cik Noorazmah. My job was at the Secured Loans department and Ann Chow was my supervisor. I assisted in typing out the loan offer letters and preparing monthly statements to be sent to the lenders. There was another staff, Nordin in this department and he made sure the procedures were followed with the proper documentation. Secured loans amounted from RM10,000 to anything higher. This type of loans needed collaterals; title deeds of businesses, house or property.

I was introduced to all the staff at the various departments; the Fixed Deposit department, Savings Department, Personal Loan, Secured Loan and the IT department. The personal loan was divided into two; servicing and recovery. It took me a few days to figure out the proceedings here. On the ground floor was the Savings and Fixed Deposit department. I had to help out at the Savings or FD for an hour during lunch so I quickly learnt what was necessary. Lunch hour was from 12.00 to 1.00 pm for 1 staff and it rotated for the back-up staff.

We started work at 9.00 a.m and at 4.30pm, when the bank closed for business, all the clerical staff would come down to the gound floor for ‘balancing’. That meant, we batched the vouchers according to the debits and credits. It was easy, debit vouchers were pink and credit vouchers yellow. Each batch had to be added and attached with an adding slip from the calculator. The figures were written on a journal form. The batches were then sent to the Accountant who would open the bundles of vouchers the next morning and check through to record in a large ledger. The batches were also matched with the daily print-out or control from a huge printer which backed up any transactions printed during the day. Every transaction needed an officer’s initial for accuracy and security. There was a strong room next to the Assistant Manager’s desk and in here, the ledger cards, cash and customers’ collaterals like the title deeds, were kept in cabinets. It looked just like the safe deposit box strong room at other commercial banks.

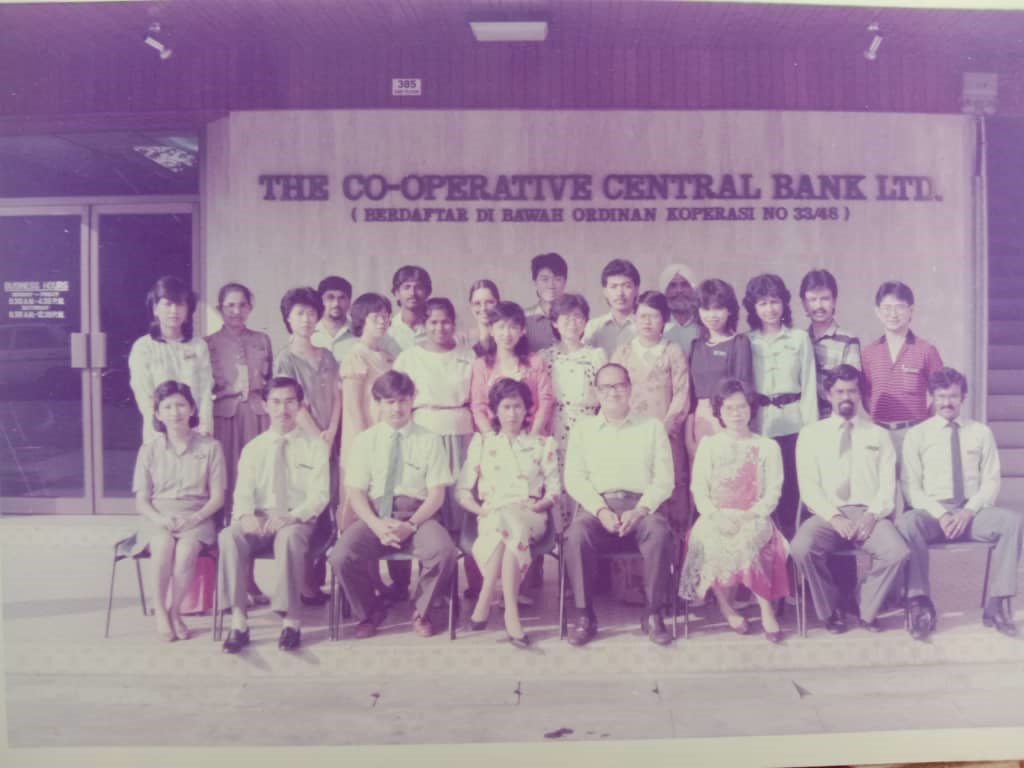

Group photo of CCB’s entire staff

Now let me take you inside the Savings department. The customers of this department were local City Council employees, government employees and semi-government employees. They opened a savings account so that they could take a personal loan. Their net salary after deductions for their loan instalment, was transferred to their savings account. There was no automated teller machine, so the employees had to come personally to this bank to withdraw their salary. Their salaries were credited the last week of the month (as instructed on the listing by their agency) and CCB would make the payout accordingly. Imagine the number of people inside the bank from 9.00 am till 4.30 pm. These customers took a token number and waited for the cashier to call their number. There were bad days when the cashiers’ computers would go offline and payout was done manually.

Any government or semi-government employee could take a personal loan which was six times their net salary (there were other deductions for housing and other government loans). After checking through the latest salary slip, the loan processing clerk would request for copies of the identity card, 2 copies of the pay-slips of member and 2 sureties. In order to apply for any loan, the person and the sureties must first be members of the bank. A new folder would be opened with the customer’s or member’s name. There were a number of forms, deduction authority form and a bureau form to be signed by the customer. Once the personal loan form was checked and verified by the officer, the clerk would proceed to issue a check after deducting the necessary processing fees. CCB did not have their own checking system, they had a bank account with a local bank and the check book was kept by the Assistant Manager. The processing clerk would use a franking machine to print out the amount on the check. This check was then signed by the Assistant Manager or the Manager and another officer. All checks were marked ‘Account Payee’ which meant that the check could only be banked in. Our customers wanted cash, so this was canceled and counter signed by the signatories.

A duplicate set of forms were sent to the bureau which did further liaising with the appropriate agency. The agency after deducting instalment for other loans, sent a net salary listing to CCB. The clerks at CCB deducted the personal loan amount and credited the net amount into the member’s saving account. So, during paydays, every staff at the bank was involved with the deducting and crediting. After the loan was disbursed, the bank waited for 2 months before the 1st instalment came in. Sometimes there was a delay and the recovery department would step in to contact the agency or the bureau. The recovery staff would also contact the member’s department or the member to investigate. All this happened on the 2nd floor, and the crowd was larger when it was near festivals. There was a filing room and it contained all the personal loan ledger cards of the members. Once payment was received, the clerk would key in and the outstanding amount would reduce. There were members who after servicing the loan for a number of years would come back for an overlapping loan. Overlapping loans meant loan disbursed after deducting the outstanding balance from the previous loan.

Once we stepped into the bank in the morning, we started work immediately and got busy. If someone wanted a cup of coffee or tea, we just picked up the phone and called Kim Chuan who was a worker at his uncle’s coffee stall in a lane beside the bank. Kim Chuan would bring the coffee and some toasted bread or cake. After quickly running to the stairway and gulping down the coffee, the staff wasted no time in getting back to work. There was pantry on the 3rd floor and coffee was prepared by either one of the 2 office boys, Iqbal or Samy. The other staff bought their lunch and ate at this pantry. Next to the pantry was the supply room where stationery was kept. Lay Ean and I would go out to Love Lane or across the street to have a lovely lunch and have a chat.

Kim Chuan is in the centre, Samy is on the right

As I said earlier, this bank operated like a commercial bank so there was money market involved. The funds received from the Fixed Deposits were either smartly invested or rolled wisely in giving out Secured and personal loans. The interests from these transactions were used for the operations. It was the work of the marketing department at the Head office level. Branch managers were required to update cash flow balances to Head quarters on a daily basis. Hence, the interest rate for the Fixed Deposits were slightly higher than the commercial banks which became a customer pull.

On 30th June and 31st December of each year, the bank closed at mid-day and the Manager took the staff to lunch. Here, we talked, and laughed like a big family but we made sure to get back to the bank at 2pm. The work of mid-year or annual balancing took us all afternoon and sometimes till midnight to tally the accounts. The interest rates were then adjusted accordingly for the new term.

It was always fun working here, there were people from all walks of life coming in to enquire about loans or savings. Sometimes we were lucky to see rich towkays paying social visits on our Manager. One day as I was walking back from lunch, on Chulia Street (right in front of the bank) traffic was at a standstill. There was honking from the motorists and I went near to see what the commotion was all about. The City Council bus driver had parked his bus right there and had gone into the bank. He gave his passbook to the cashier and ran back to his waiting bus with the passengers sitting in it. This strange incident tickled me and we laughed as we talked about it in during balancing time.

Loans department staff on the 1st floor

I worked here happily for about 5 years and on one fine day, all the employees were called in for a meeting. We were all given termination letters and it was a shock to us. Some had to leave right away but some were given offer letters to work on a month-to-month basis. We were shattered, we had been kept in the dark and did not know what had really happened. The receivers took over the operations of the bank from that day and we worked under their watchful eye. Fear gripped us as each day passed at the bank.

After consulting with some Unions, we were advised to picket. We made placards after office hours and started to stand outside the bank during our lunch hour. Motorists and drivers honked as they passed by to give us support. This continued for some time but we were hopeful. Soon a number of officers were transferred to other branches. The existing branches were downsized and slowly we were closing off. Fixed deposit members rushed to the bank to get their refund. It was chaotic but the receivers managed it well.

Co-operative Central Bank closed down due to mismanagement of funds. At the branch level, we were meticulous, ensuring transactions were conducted with full honesty. The staff filed court proceedings and got compensated after a few years. Some time early 1990, I had tendered my resignation and moved to Kuala Lumpur.

Today, as I drive past Chulia Street, fond memories come to my mind. I had registered at the Institute of Bankers Malaysia hoping one day I would excel to be a bank official but that dream vanished with the closure. The place is deserted now, no cars are parked outside and there is no hustle and bustle outside the bank. Some food stalls are set up in the evening at the entrance of this once beautiful bank. I found some of my colleagues after a long time; Kim Ai, Malkit, Janet, Nordin, Loges, Samy, Iqbal, Lay Ean, Roselyn, Vincent, Ong, Suzana, Azhar, Ng, Fadzil, Mazni, Yatie. Others will always stay in my heart.